Navigating Dental Student Loans – Tips For Managing Your Debt After Graduation

Loans can feel overwhelming, especially as a recent dental graduate burdened with significant student debt. However, with the right strategies, you can effectively manage your financial obligations while building a successful career. It’s imperative to understand your repayment options and to prioritize budgeting, ensuring you don’t fall behind on payments. Additionally, exploring loan forgiveness programs and consolidation options can help lighten your financial load. In this post, we’ll provide you with valuable tips to navigate your post-graduation debt and pave the way for a healthier financial future.

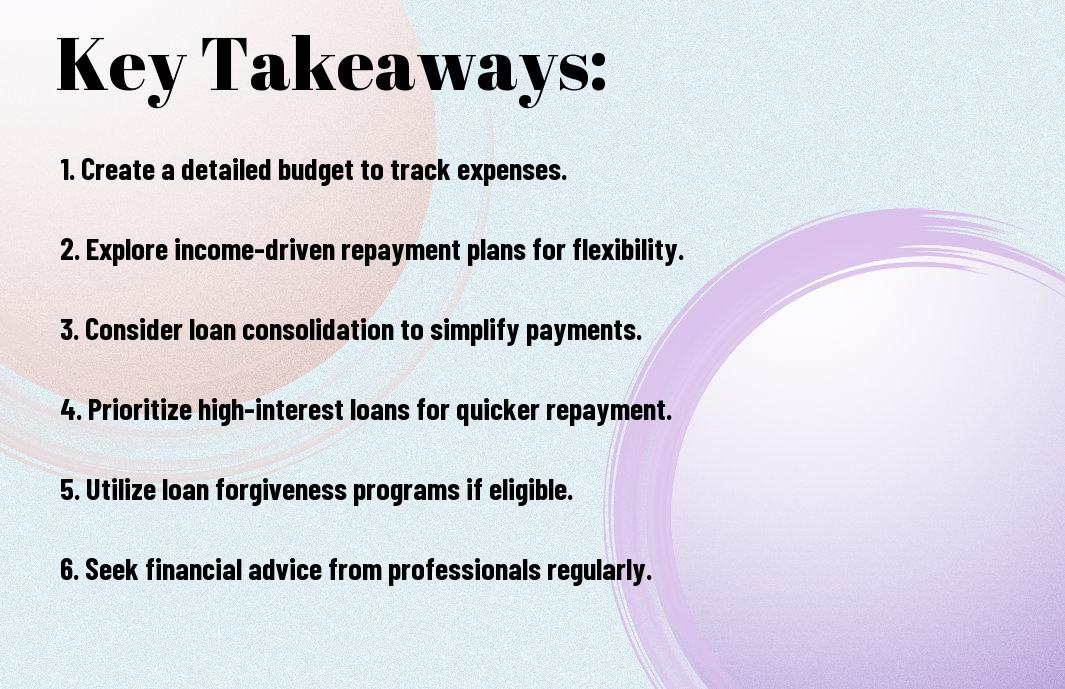

Key Takeaways:

- Understand Your Loan Types: Familiarize yourself with the different types of student loans you have, including federal, private, and any scholarships or grants.

- Develop a Budget: Create a detailed budget that accounts for your living expenses, loan payments, and any additional costs you may incur.

- Repayment Options: Explore various repayment options available for federal loans, including income-driven repayment plans that can reduce your monthly payments.

- Loan Forgiveness Programs: Research eligibility for loan forgiveness programs that may be available for dental professionals serving in specific areas or working in public health.

- Prioritize Payments: Strategically prioritize your loan payments to minimize interest and pay off higher-interest loans first, if applicable.

Understanding Dental Student Loans

Before you begin on your dental career, it’s imperative to have a clear grasp of your student loans. Understanding how these loans work will empower you to make informed financial decisions while navigating your post-graduation repayment journey. With various options at your disposal, knowing the specifics can help you manage your debt more effectively.

Types of Loans Available

Before selecting a loan, you should explore the different options tailored for dental students:

- Federal Loans – Government-backed with favorable repayment options.

- Private Loans – Offered by banks and credit unions, often requiring credit checks.

- Direct PLUS Loans – For graduate students with eligibility requirements.

- Institutional Loans – Offered by dental schools to help cover costs.

- Internship Loans – Designed to assist students during their clinical training.

After researching loan types, you’ll be better equipped to choose what’s right for your financial situation.

Beside knowing the loan types, it’s vital to understand how interest rates and loan terms can impact your overall debt. Each loan comes with different rates, which can be fixed or variable, affecting your monthly payments and long-term financial planning.

Interest Rates and Terms

Across various loan options, interest rates and terms significantly shape your repayment plan. Federal loans typically offer lower rates compared to private loans, which often come with variable rates that fluctuate over time.

Understanding the interest rates associated with your loans is imperative for effective financial management. Federal loans often have lower, fixed rates around the 4% to 7% range, which allows for predictable payments. In contrast, private loans can exceed 10% and may use variable rates, increasing your total payment amount over time. Be cautious of high-interest loans, as they can drastically increase your overall debt burden. If possible, explore income-driven repayment plans to alleviate some financial pressure post-graduation.

Creating a Budget for Repayment

Even after graduation, managing your dental student loans begins with a well-structured budget. Establishing a budget will help you track your income and expenses, ensuring that you allocate enough for loan payments while still covering your living costs. Take the time to review your financial situation and create a budgeting plan that aligns with your post-graduate lifestyle and financial goals.

Calculating Living Expenses

With the transition from student life to practicing dentist, it’s vital to accurately calculate your monthly living expenses. Compile a list of necessities such as housing, utilities, groceries, and transportation. Don’t forget to account for insurance and unforeseen expenses. By understanding these costs, you can better tailor your budget to accommodate both your living requirements and debt repayment needs.

Allocating Funds for Loan Payments

Loan payments should be a key component of your budget. Aim to set aside a designated amount each month that allows you to meet or exceed the required payments while also planning for additional savings.

But allocating funds for loan payments goes beyond just meeting minimum requirements; it’s about strategically planning to reduce your overall debt. Start by prioritizing higher-interest loans to minimize total interest paid over time. Establish a balance between paying off debt and maintaining an emergency fund. Adapting your payment strategy based on your income fluctuations is also vital—if you earn more one month, consider making an additional payment. The goal is to avoid undue stress while making sure you actively chip away at your student loans efficiently.

Exploring Repayment Options

Unlike federal loans, private student loans may have less flexible repayment terms, making it vital to understand your options. You’ll want to evaluate various repayment plans available through your loan servicer, as this choice can significantly impact your financial situation post-graduation. Whether you are looking for stability with a fixed payment or wish to adjust based on your income, knowing your options allows you to tailor a strategy that works best for your circumstances.

Standard vs. Income-Driven Repayment Plans

Repayment options primarily fall into two categories: standard and income-driven plans. With standard plans, you make fixed monthly payments over a set period, while income-driven plans adjust your monthly payments based on your earnings, offering more flexibility. Choosing the right plan requires careful consideration of your income, job stability, and overall financial goals.

Loan Forgiveness Programs for Dentists

Loan forgiveness programs provide a pathway for reducing or eliminating your student debt through specific service commitments.

With various programs available, such as the Public Service Loan Forgiveness (PSLF) and National Health Service Corps (NHSC), you may qualify for significant debt relief after fulfilling specific employment criteria. Typically, these programs require you to work in underserved areas or within public health settings for a designated period, usually ten years. It’s vital to meet the requirements and understand the application process, as this can lead to complete forgiveness of your remaining student loans, allowing you to focus on your dental career without the burden of debt.

Strategies for Debt Management

After graduation, managing your dental student loans effectively is imperative for achieving financial stability. Establishing a well-thought-out plan can help you minimize your debt burden, allowing you to focus on your practice and personal goals. Implement strategies that work best for your financial situation, which can lead to improved cash flow and reduced stress in the long run.

Making Extra Payments

By making extra payments towards your loans each month, you can accelerate your repayment timeline and reduce the amount of interest you pay over time. Even small additional payments can significantly impact the total debt, allowing you to become debt-free sooner and freeing up your finances for other opportunities.

Refinancing Options

With many refinancing options available, you may be able to secure a lower interest rate or better loan terms. This can lead to lower monthly payments, allowing you to allocate more funds towards savings or investments. By evaluating your financial situation and checking your credit score, you can identify the best refinancing options that suit your needs.

Also, consider that refinancing can significantly reduce your interest rates, especially if you have improved your credit score since acquiring your loans. However, be cautious of the potential risks, as refinancing federal loans means you may lose access to benefits like income-driven repayment plans and forgiveness options. Make sure to weigh the pros and cons and choose a refinancing solution that aligns with your long-term financial goals.

The Importance of Financial Literacy

Many dental graduates find themselves overwhelmed by student debt, making financial literacy an imperative skill for managing repayments and achieving financial stability. Understanding the nuances of loans, interest rates, and budgeting enables you to make informed decisions that can positively impact your future. By enhancing your financial literacy, you’ll be better equipped to navigate the complexities of your debt and ensure a healthier financial life post-graduation.

Resources for Ongoing Education

Above all, continuous financial education is key to managing your debt effectively. Consider exploring online courses, webinars, and financial literacy programs tailored specifically for dental professionals. Websites like the National Endowment for Financial Education and various professional associations offer valuable tools to help you stay informed and make sound financial choices.

Seeking Financial Advisors

Literacy in personal finance also means recognizing when to seek professional guidance. Consulting a financial advisor can provide you with tailored strategies and insights that accommodate your specific circumstances. A qualified advisor can help you understand various repayment options, investment strategies, and budgeting techniques, ensuring that you not only tackle your debt but also plan for your financial future.

And while finding a financial advisor, prioritize those who specialize in helping dental graduates or similar professions. Look for advisors who have a strong reputation and transparent fee structures. Their expertise can illuminate options you may not be aware of and help you avoid common pitfalls like accumulating excessive debt or making poor investment choices. Choosing the right advisor can help you build a stable financial foundation now and in the years to come.

Preparing for Financial Challenges

To successfully navigate the financial landscape after graduation, you need to be proactive in preparing for potential financial challenges. This involves understanding the reality of student debt, setting a budget that reflects your new income, and anticipating future expenses related to your practice or living circumstances. Doing so can ease the shock of transitioning from student life to professional responsibilities.

Emergency Funds and Savings

Challenges can arise unexpectedly, making it imperative to build an emergency fund that can cover at least three to six months of expenses. Start saving now, even in small amounts, and prioritize financial security. This will allow you to focus on your career without the constant worry of financial strain.

Managing Unexpected Expenses

Against the daily demands of your new career, unexpected expenses can arise, ranging from sudden medical bills to urgent home repairs. Having a strategy in place to handle these costs will help you avoid falling into debt.

With a solid emergency fund, you can confidently address these unforeseen costs without resorting to credit cards or loans that may jeopardize your financial stability. Establish a clear budgeting plan that anticipates various scenarios, and remain adaptable to adjust your spending as needed. Maintaining a well-rounded approach to managing expenses will allow you to cultivate a positive relationship with your finances while easing the stress associated with unexpected financial challenges.

Summing up

With these considerations, you can effectively manage your dental student loans after graduation. Prioritize understanding your repayment options, create a detailed budget, and explore loan forgiveness programs tailored for dental professionals. Staying organized and proactive with your financial planning will help ease the burden of your debt. By seeking advice from financial experts when needed and making informed decisions, you can build a solid foundation for a successful financial future in your dental career.

Q: What types of loans are available to dental students?

A: Dental students typically have access to several types of loans, including federal direct loans, federal graduate PLUS loans, and private loans. Federal loans often have lower interest rates and may offer income-driven repayment plans, making them more favorable for many students. Private loans may have varying terms and conditions based on the lender and the borrower’s credit history.

Q: How can dental students create a budget to manage their loan debt effectively?

A: Creating a budget involves tracking monthly expenses and income. Dental students should identify fixed costs such as rent, utilities, and loan payments, as well as variable expenses like food and entertainment. Utilizing budgeting tools or apps can help in organizing finances. Setting specific savings goals, such as an emergency fund, can also aid in managing debt post-graduation.

Q: What are the benefits of income-driven repayment plans for dental graduates?

A: Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size, making them more manageable for graduates with student loans. After 20-25 years of qualifying payments, any remaining balance may be forgiven. This approach can significantly reduce financial strain, especially during the early years of a dental career when income may be lower.

Q: How can refinancing help dental graduates manage their student loans?

A: Refinancing involves taking out a new loan to pay off existing student loans, ideally at a lower interest rate. For dental graduates with stable income and good credit, refinancing can result in reduced monthly payments and overall interest costs. However, it’s important to weigh the benefits against potentially losing federal loan protections like income-driven repayment options.

Q: What strategies can dental graduates use to accelerate loan repayment?

A: Dental graduates can consider several strategies to pay off loans more quickly. Making extra payments, even small amounts, can reduce interest accrual over time. Graduates might also choose a repayment plan with a shorter term, resulting in higher monthly payments but lower total interest paid. Additionally, setting up automatic payments often results in interest rate discounts offered by some lenders.

Q: How do loan forgiveness programs work for dental professionals?

A: Loan forgiveness programs offer relief for borrowers who meet specific criteria, such as working in underserved areas or in public service positions. The National Health Service Corps and Public Service Loan Forgiveness programs are examples where dentists may qualify for partial or total loan forgiveness after a set number of qualifying payments. It’s imperative for graduates to research available programs and understand their requirements fully.

Q: What should dental graduates look for when choosing a loan management service?

A: When opting for a loan management service, dental graduates should consider factors such as customer service support, fees, online resources, and user reviews. A reputable service will provide personalized advice, have a clear fee structure, and offer resources like budgeting tools or access to financial advisors. Additionally, graduates should ensure the service understands the unique financial situations of dental professionals.